U.S., U.K, and China Lead Foreign Land Investments In Agriculture and Finance

GRAIN’s online database is the foundation for much of what the world knows about foreign investments in land. Though the majority of “land grabs” are for agribusiness, other sectors include construction, finance, industry, real estate, and more.

By Keith Schneider

Circle of Blue

Over the past two years, awareness of the huge global trade in land for farming and other industrial purposes has risen dramatically.

In May 2010, The Observer, a London-based news organization, published a startling report about big investors from outside Africa that had purchased or leased 50.5 million hectares (125 million acres) of farmland on the continent in just a few short years. Four months later, a separate study by the World Bank found that nearly 60 million hectares (150 million acres) of African land — an area the size of France — had been purchased or leased by foreign companies between 2006 through 2009.

Just a year ago, researchers and activists from around the world gathered at the University of Sussex in Great Britain for the first conference to explore the global trend that is steadily pushing land ownership away from small farmers and into the portfolios of foreign countries, international food companies, and investors.

Underlying each of these events — and dozens more that have boosted the visibility of the huge global trade in farmland — is an online database of land sales and leases, built and managed by GRAIN. The 21-year-old international non-profit research and policy organization advocates for small farmers around the world. Its respected online database is widely regarded as the first stop for serious research on the global market in farmland.

GRAIN, which is based in Barcelona, employs eight people and operates on a $US 800,000 (600,000 euros) annual budget, a portion of which is used to scour the Internet, news reports, news releases, investor alerts, government announcements, and company news to amass its up-to-date online compendium of land deals.

The organization’s work to discover the details of the scope and scale of global land deals is widely regarded as state of the art. Along with data compiled by The Oakland Institute, Oxfam, Friends of the Earth, and the International Land Coalition, GRAIN’s database is seen by researchers as consistently and accurately measuring trends in global land transactions.

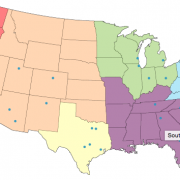

Grabs in 66 Countries: Mostly for Farming, Mostly in Africa

Earlier this year, in its most comprehensive assessment to date, GRAIN reported that, since 2006, foreign investors had made 416 large-scale land purchases and leases — what GRAIN provocatively calls “land grabs”. The land transactions covered nearly 35 million hectares (86.5 million acres) in 66 countries, with more than 40 percent of transactions classified as agribusiness, nearly 30 percent as finance, and nearly 20 percent as government uses. Africa was the target of most of the transactions, said GRAIN, but foreign buyers also made big land deals in South America, Asia, and Europe.

“The collection of deals provides a stark snapshot of how agribusiness has been rapidly expanding across the globe since the food and financial crises of 2008,” GRAIN said in February, when making the new report public. “This is taking food production out of the hands of farmers and local communities. It confirms that Africa is the primary target of the land grabs, but it also underlines the importance of Latin America, Asia, and Eastern Europe, demonstrating that this is a global phenomenon.”

What the big land sales and leases mean — to communities, water, the quality of land, and the global food supply — is in dispute, though most researchers agree that the trend is worrisome.

GRAIN and a number of other non-profit public interest organizations that study the trend contend that such sales represent a threat to small-scale farming practices that sustain local lands and water resources, as well as providing food and income to rural communities. They argue that the big sales executed by multi-national companies and richer nations — China, India, and Saudi Arabia are big players — are replacing tried and true indigenous agricultural methods, which provides a variety of food for poor countries, with industrial practices devoted to producing biofuels, grain, and other commodities for the global market.

Water-Food Nexus

Rising commodity prices, which are driving up the value of farmland around the world, play big roles in accelerating the trend of foreign farmland ownership. But another important factor is securing access to fresh water for food production. In a paper, two University of Manchester researchers concluded that “water scarcity is a major driver of international flows of investment in agricultural land.”

“Local scarcity of water for agricultural use is emerging in economies that are expanding particularly quickly, such as India and China, and where renewable water resources are particularly limited, such as the Gulf countries,” wrote the report’s authors, who presented last year at the event at Sussex University.

As a follow-up, the second annual global conference to “continue deepening and broadening our understanding of global land deals” will be held at Cornell University in Ithaca, New York, from October 17 to October 19 of this year.

“Most of these deal are happening in countries that already are grappling with issues of hunger and security,” said Devlin Kuyek, a GRAIN researcher based in Montreal, Canada. “These are places that already have issues of access to land and water. What’s happening is that the land grabbing takes away food and resources and hands them over to the world’s wealthiest. They also destroy sustainable agricultural practices and replace them with large-scale monocultures that tend to use a lot of water and deplete the soil. “

In their report, the authors of the 2010 World Bank study urged governments to require buyers and sellers to operate more transparently and to develop rules and safeguards that protect small landowners from exploitation.

“As rising food and fuel prices create incentives for large-scale land acquisitions around the world, it is more important than ever for governments and the international community to protect local land rights,” said the World Bank, when releasing the report in September 2010.

“There’s a billion people who already don’t have enough to eat,” Kuyek said in an interview with Circle of Blue. “Right now, there is a rush from certain countries to ensure food security by outsourcing it to other countries. Companies are looking to make a profit by controlling water and land — the resources to food production. The grab for land by outsiders means it is much more difficult for people who live in these regions to produce the food they need.”

Map created by Varun Mangla, an undergraduate student at the University of Michigan and a Traverse City-based data intern for Circle of Blue, with contributions from Circle of Blue’s data and web publishing staff, Aubrey Ann Parker and Jordan B. Bates. Technical assistance from Rebecca Shapley of Google Fusion Tables. Reach Varun at circleofblue.org/contact.

Circle of Blue’s senior editor and chief correspondent based in Traverse City, Michigan. He has reported on the contest for energy, food, and water in the era of climate change from six continents. Contact

Keith Schneider

We will no doubt continue to see nations buying up productive assets in other nations as Investors continue to align their asset base with basic trends in driving fundamentals such as population growth and socio-economic progressions and advancement in developing nations. And this investment is really the only way to bring in the capital required in order to bring productivity up to modern stadards in many less developed parts of the world. What needs to happen is a framework to ensure that indigenous populations do not suffer as a result. we do not want to see subsistence farmers cleared from their land which is then used to grow sugar for biofuels to power and industry thousands of miles away. we need to make sure that the profit-opportunitiy is married to social responsibility – after all, proiftability and sustainability are not mutually exclusive concepts!