Water-intensive Companies Fail to Disclose Water Risks, Report Says

Investor network recommends companies provide more specific, quantifiable data on water risk.

Large companies in water-intensive industries are poorly managing and reporting water-related risks, according to a study from a coalition of investment funds and environmental groups.

Large companies in water-intensive industries are poorly managing and reporting water-related risks, according to a study from a coalition of investment funds and environmental groups.

The Ceres report criticizes companies for using vague, non-quantified language about water risk and recommends water risk information be included in mandatory financial filings with the U.S. Securities and Exchange Commission.

“The combination of rising global populations, rapid economic growth in developing countries, and climate change is triggering enormous water availability challenges around the world. Electric power generators, food producers, and other water-intensive industries are especially vulnerable, both in their operations and their extensive supply chains,” the report states.

Data from regulated financial filings and voluntary corporate reports from the 2008 fiscal year were used to rank 100 of the largest publicly-traded companies in eight industrial sectors, based on their water-risk disclosure and management.

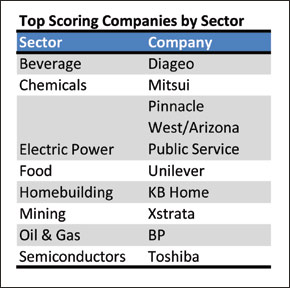

Sectors evaluated include beverage, chemicals, electric power, food, home building, mining, oil & gas, and semiconductors.

The report found that companies are neglecting two important pieces of information: site-specific water use and supply chain risk.

The report recommends that companies

- 1) Include water risk and performance data in regulated financial filings

- 2) Include facility-level water use information for water-stressed areas

- 3) Set quantifiable targets for reducing water use

- 4) Disclose water-related risks in their supply chains

- 5) Make products suitable for a water-constrained world

Even though 73 percent of the companies that were surveyed reported some level of physical risk in their financial filings, the information needs to be less generic, said Brooke Barton, the report’s lead author and a senior manager for Ceres’ water program.

“One useful global metric is the percentage of facilities or revenue that comes from water-stressed regions,” Barton told Circle of Blue. “There are companies beginning to talk about this but not enough. Not every facility should be highlighted, but certain areas need more detail.”

Two-thirds of the companies reported total water use, but less than 20 percent of them break down the information by site or region.

The beverage and mining industries rated the highest in the survey-–a result of the high level of public scrutiny these industries face, Barton said.

“A loss of community consent has had serious bottom line impacts for some companies,” Barton said.

“Ore is a fixed asset – you can’t move it. Companies have had to find a way to work with local communities. There is a reputational impact if something goes wrong. Companies need to own this issue and communicate about it. There has also been a lot of local regulation for mining.”

Swiss mining firm Xstrata-–the top scorer for its sector-–is one of three companies surveyed that set water reduction targets based on the level of water scarcity in each of its operating regions.

Companies without effective management policies did not fare well. Computer chip maker Micron ranked last in the semiconductor industry and scored the fewest points overall in the survey. Company representatives did not return phone messages seeking comment by the time this article was published.

Brett writes about agriculture, energy, infrastructure, and the politics and economics of water in the United States. He also writes the Federal Water Tap, Circle of Blue’s weekly digest of U.S. government water news. He is the winner of two Society of Environmental Journalists reporting awards, one of the top honors in American environmental journalism: first place for explanatory reporting for a series on septic system pollution in the United States(2016) and third place for beat reporting in a small market (2014). He received the Sierra Club’s Distinguished Service Award in 2018. Brett lives in Seattle, where he hikes the mountains and bakes pies. Contact Brett Walton

Leave a Reply

Want to join the discussion?Feel free to contribute!