Global water business, a growth industry, attracting more investors

Realistic expectations drive long-term gains, experts predict

by Keith Schneider

Circle of Blue

NEW YORK – It didn’t quite land with a thunk!, but it did attract some attention last August when a 16-page investment brochure from Dublin, California dropped into the mailboxes of stock buyers all over the country. “Water stocks,” declared the investor report, “are set to go bonkers!”

A month later, of course, the two largest mortgage banks in the United States were insolvent, Lehman Brothers collapsed, and Congress approved a $700 billion rescue plan as stock markets all over the world crashed. It is far from clear how the election of Barack Obama to the American presidency will influence market behavior.

Still, executives and analysts say the domestic and global market for the pipes, pumps, filters and other equipment to deliver and purify fresh water is steadily growing, and providing opportunities for long-term investment.

In spite of all the financial challenges of the last month, there is plenty of money that could be applied to the water problem.

“In spite of all the financial challenges of the last month, there is plenty of money that could be applied to the water problem,” said Paul Reiter, executive director of the London-based International Water Association. “It’s creating realistic expectations on the investors’ side, and an environment in which those investments can be made at pace with people’s income and economic development.”

Noting that 95 percent of water is provided by public agencies, and that infrastructure costs are high, debt-laden, and rates of return tend to be low, Reiter said the water play tends to take years to mature. “The picture that you want to have is not of going from here to there,” he said. “It’s a picture of stair-step investments that both lead and follow the income stream of that community.”

A $400 Billion Market

Just how big is the world’s water industry? Nobody is quite sure. Goldman Sachs, the New York investment bank, puts the global market for pumps, pipes, filters, and other purification and sanitation equipment at $400 billion. The Pacific Institute’s latest World’s Water, a bi-annual report published two years ago, estimates that the United States share of the industry amounts to roughly $100 billion in yearly sales, and growing three to four percent a year.

How much larger will the industry get around the world? Much larger, say analysts, a view shared by environmental, business development, and international relations agencies in the United States and globally.

The reason? The planet’s growing population and climate change is making freshwater scarcer. At the same time rising wealth in developing nations is prompting new investments in pipes, filters, pumps, purification plants, and other equipment needed to produce and transport water.

Moreover, industrialized nations have deferred infrastructure development and maintenance, producing an immense new market for water transport and filtration systems. The market for new water infrastructure development in the United States, according to several estimates, could be $1 trillion.

And last, global investors are looking past the potentially significant geo-political and cultural consequences and starting to see fresh water as a commodity — just like gold or oil — a commodity that is under appreciated, undervalued, and growing scarce. Significant investments are being made in desalination in Israel and California, according to news reports. China is transferring water, through a sturdy new system of canals and pumps, from the southern region of the country to the arid north.

The Water Investor Class

T. Boone Pickens, the billionaire oilman, spent over $100 million since 1998 purchasing land in the Texas Panhandle and the water rights beneath it. He’s planning to build the largest wind farm in the world on the surface. And he announced another plan, temporarily suspended, to sell $165 million worth of water to Dallas, which is 165 miles away.

“Water is a growth driver for as long and far as the eye can see,’’ Deane M. Dray, who follows many water companies for Goldman Sachs, told the New York Times earlier this year.

Major companies are getting involved. Siemens Water Technologies, accounted for about $2.42 billion (€1.9 billion) of Siemens’ $96.0 billion (€75.4 billion) it earned in revenue last year. ITT Water Technologies accounts for 40 percent of the more than $10 billion (€7.85 billion) that the White Plains-based company will earn this year. Dow has invested hundreds of millions of dollars in water equipment companies over the last year.

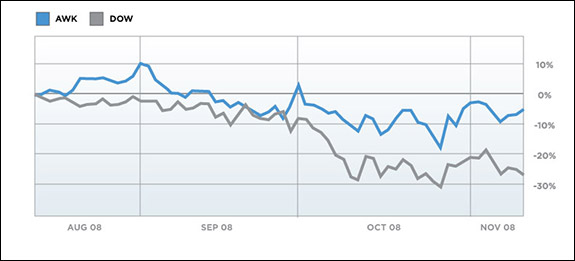

Before the collapse of the credit and stock markets, that kind of market interest put companies that treat, move, purify, pump, and sell clean fresh waters among the most attractive industrial investments. Analysts who follow the industry say water stocks have followed markets down over the past month, though in some cases less steeply than auto, banking, steel, and housing company shares. But once the markets recover, say analysts, the underlying fundamental trends in population, growing wealth, water scarcity, infrastructure, and competition for fresh water could prompt a boom in water company investment.

The water sector is not recession proof. But it is recession resistant.

“The water sector is not recession proof. But it is recession resistant,” said Neil D. Berlant, an investment banker and manager of the PFW Water Fund, who has been involved in the industry for more than two decades. “We are talking about things here that are absolutely essential. Demand for water will never go to zero or you will die. Demand for processing will never go to zero.”

Outlook For Water Investment

Berlant and the growing number of analysts who follow water related shares say the industry has resisted the downward trend that affected most other industries. For instance, one widely watched water fund, PowerShares Water Resources, broke even in the year that ended in the second week of September. In comparison, during the same period, Standard & Poor’s 500-stock index fell 14 percent.

Top performers in the water industry include Northwest Pipe, a pipe manufacturer, jumped 49 percent in 2008 before the market crash. Shares of American Water Works, a utility, rose 3 percent from April, when the company went public, outperforming almost every other utility until the market downturn.

The United States has 60,000 municipal water companies and some 1.5 million miles of pipe to transport drinking water and wastewater. Over the next five years, 70 percent of the network will surpass its useful life. That means pipe builders will be busy replacing the nation’s network of concrete pipes. What’s more, despite a deepening drought in the southwest, the fastest growing region in the United States is southern California, Arizona, New Mexico, Utah, and Colorado, all desert states. States and local governments are planning to add infrastructure to move water to thirsty communities and industries.

Overseas, say global stock analysts, water companies also are in position to take advantage of rising demand. Sextant Capital, a hedge fund, purchased water rights to three glaciers in northern Europe, and are planning to bottle or ship melting glacier water that can be sold to thirsty parts of the world.

France’s Veolia Environnement earns more than half of its revenues from managing municipal and industrial water facilities around the world. It has desalination operations in Spain, Australia and the United Arab Emirates.

Veolia also serves 29 million people in China, where it supplies water and operates a treatment facility in the city of Shenzhen, just north of Hong Kong. It also recently signed a water supply agreement in Tianjin, the nation’s third-largest city after Beijing and Shanghai.

Press reports say rising fuel prices have hurt Veolia’s transport and other non-water businesses, which have cut its stock price to $47 a share, a nearly 50 percent drop since December 2007. But analysts who follow the company anticipate a 17% jump in profits next year, to $3.59 per share and the stock trades at a reasonable 13 times expected earnings.

Another company to watch, according to analysts, is Ameron International, which makes concrete and steel pipes for transporting water. Ameron has strong pipeline businesses in South America, Europe and Asia, along with several joint ventures in the Middle East, so it seems well positioned to benefit from the global surge in water demand.

William Brennan, president of Aqua Terra Asset Management and one of the top water analysts, says the company, which recently bought a fiberglass-pipe manufacturer in Brazil, could be in the market for more acquisitions. Brennan forecasts $6.86 in earnings per share for the fiscal year that ends November 2008, up 12 percent from 2007. At $109, the stock sells for 13 times the 2009 fiscal forecast.

Still, even as the water industry has experienced steady growth worldwide, many executives and analysts anticipate significant turbulence. The reason, they say: The price of water has begun to climb as competition for the resource increases. Prices could triple in the United States within the next decades, says Berlant.

Since Pickens announced his plan, according to local news articles, the price of water in some places in Texas has doubled to $600 an acre foot. The price of water rights in the Middle Rio Grande in New Mexico reached $5,500 an acre-foot two years ago, up from $1,000 an acre foot in 1993.

PICO Holdings owns 100,000 acre-feet of water rights in Nevada and Arizona and seeks to expand its western water rights in the United States.

For the time being water is cheap in most of the United States and under valued in most other parts of the world. Homeowners in southern California, for instance, pay about $3 for 750 gallons of water, or what the average American uses in a week.

“Water will become much more politicized over the next decade,” said Berlant. “Not because of water shortages. We don’t really have shortages of water here. What we have is a shortage of cheap water. As the price of water rises we will become much more aware of it. What you get for free you tend not to pay much attention to. The price of water is going to rise dramatically. Over the next few years water prices could double or triple and we will see an entirely different way that people look at it, expect it, and demand it.”

Keith Schneider, a former New York Times national correspondent, is senior editor and producer at Circle of Blue. C.T. Pope, a Circle of Blue researcher, contributed to this article. Contact Keith Schneider

Circle of Blue’s senior editor and chief correspondent based in Traverse City, Michigan. He has reported on the contest for energy, food, and water in the era of climate change from six continents. Contact

Keith Schneider

The water issue is a very critical issue globally, and as such the economic part of water should be considered even though water is perceived to be for free or not for sale and only the services provided to supply the water are the heart core of the water matter with regard to revenue or tariffs.

Globally there are many areas which live without water and more amazingly without water of good quality due to the economic influences on water resources, this is mainly caused by the little knowledge attained by professionals in the scope of water economics. There is a need to emphasize the effectual and potential impact of economy on our water, because economy is the basic start for sustainable potential and viable planning in all resources. whiles in water resources it plays an affluent role of making it possible for all to reach a conducive state of being with regard to water quality and quantity.

The elusiveness of combining and relating IWRM issues

It is of importance considerations to look at the issues in integrated water resources management. There are some bit of difficulities in managing water resources, I’m tempted to believe that the linkage and breakingdown of the GWP tools to achieve the IWRM process is the first step to follow in reaching a sound and reasonable sustainable water resources management.

thus linking water quality with its quantity because one will never benefit from quantity of water without it being of a suitable condition, it is therefore important to integrate all the GWP individually according to their linkages, i.e quality and quantity, uptream and downstream water, surface and ground water etc. It is imperative to then understand that all the GWP at the end of the day interact and core-relate.

Elaborating a bit more on how they relate, we cannot divorce water from the land in reality, but that can only be applicable with policies, i.e the DWAF policy abolishing the repairain princible yet recognizing that even though they took over all water resources in South Africa they can only manage the water which is on the land, it is therefore vital to consider the land as part of the environment on which water occurs or on which water is available. The integration of land with water can then connect with water quality in its quantity, thus they all interact, they are one and need to be accounted for.

not very nice

Hello, good day, Im looking for ways on how to implement projects like river mouth dam without jeopardizing fresh water salinity.

Can you help pls